As your business expands, navigating challenges such as risk management, credit control, cash flow, and customer satisfaction can become increasingly complex. However, there is a solution that cannot only simplify these challenges but also bring about significant enhancements to your business operations and foster stronger customer relationships. This solution optimizes the Order to Cash (O2C) process. Streamlining this cycle can unlock benefits, inspiring you to take your business to new heights.

Every business shares a fundamental objective of prioritizing customer satisfaction. This journey commences during marketing endeavors, where goods or services are promoted to potential customers. However, critical interactions unfold when a customer orders, triggering activities culminating in order fulfillment and related operational processes. This is where the Order to Cash (O2C) process, in which your role is pivotal, comes into focus. It extends beyond the mere transaction of products or services; it underscores the importance of delivering a seamless and exceptional experience to your valued customers.

The progression of a customer order initiates a critical and sophisticated series of processes that can profoundly influence your organization’s operational framework. From the inception of an order to its ultimate payment processing, establishing clear and well-defined procedures across the entire lifecycle is paramount to ensuring consistent value delivery to customers and securing timely payments. This is where the concept of order-to-cash (OTC process or O2C) emerges as a fundamental driver of organizational efficiency and financial stability. The urgency of optimizing this process becomes apparent when you consider its direct impact on your company’s financial health, as it directly affects cash flow and profitability.

Order-to-cash represents a comprehensive end-to-end process that commences with customer order placement and culminates in payment collection and comprehensive reporting. This process encompasses interconnected activities, including order management, credit control, inventory management, order fulfillment, invoicing, accounts receivable management, and meticulous payment handling. However, optimizing this process is not without its challenges. It requires careful planning, coordination among different departments, and a commitment to continuous improvement. Despite these challenges, effective management of the order-to-cash cycle is pivotal for optimizing cash application automation and directly impacts customer satisfaction levels and overall profitability.

The seamless coordination and integration of various departments within this process are pivotal for organizations aiming to optimize operations and elevate customer experiences. By embracing best practices and leveraging tech solutions, organizations can enhance operational efficiency, mitigate risks, and foster enduring customer relationships, driving sustainable growth and competitive advantage in today’s dynamic business domain.

Given the various components involved, it is crucial to fine-tune the order-to-cash process to achieve optimal results such as heightened customer satisfaction, improved profitability, and reduced operational inefficiencies.

Let’s explore the definition of the order-to-cash process and its flow, then discuss some best practices within the framework that can drive operational excellence and enhance overall business performance.

What is the Order to Cash Process?

The order-to-cash process, or O2C or OTC, encompasses a company’s entire order management system. It commences when a customer initiates an order and concludes upon the settlement of an invoice.

This process constitutes a series of business functions to manage all time-related aspects within marketing, sales, and branding domains. The efficiency of O2C procedures significantly impacts a company’s success and customer relationship.

While some may perceive the order-to-cash cycle as complete upon receiving payment from a customer, numerous critical steps follow. Activity data must be meticulously recorded throughout the O2C cycle and thoroughly analyzed to pinpoint areas for optimization and enhancement.

Useful Link: The Impact and Benefits of AI in the Automotive Industry

Why is the Order to Cash Process Important?

Optimizing the order processing system is imperative for businesses due to its wide-ranging impacts. Order to Cash (O2C) activities affect various aspects of an organization, from supply chain management to labor and inventory, highlighting its importance across different business units.

1) Accounts Receivable Impact

A subpar order-to-cash process often delays invoice collections, affecting a company’s cash inflows. The efficiency of accounts receivable and the invoicing system within the O2C cycle directly influences vital financial areas such as accounts payable, payroll, potential acquisitions, general ledger accuracy, and overall liquidity management.

2) Reliability Demonstration

Effectively managing the O2C process showcases a company’s comprehensive competency in handling business operations. Success in every aspect, including sales, marketing, manufacturing, fulfillment, technology management, accounting, and shipping, reflects a company’s reliability and professionalism.

3) Enhanced Efficiency

A streamlined order-to-cash process enables a company to convert raw materials into marketable products faster, facilitating timely billing and customer receipt. By optimizing workflows within the O2C cycle, businesses can reduce cash tied up in inventory stages, freeing up resources for further investment in growth opportunities and maintaining competitive pricing strategies.

The Essential Stages of the Order to Cash Process

The Order to Cash (O2C) process comprises eight distinct steps:

- Order Handling

- Credit Control

- Order Fulfillment

- Shipment

- Invoicing

- Accounts Receivable (AR) Management

- Payment Collection

- Data Analysis and Reporting

These steps collectively form the O2C cycle, encompassing various activities from order initiation to payment and reporting.

Useful Link: How Veritis Anticipates and Resolves Financial Service Challenges

Key Metrics for Evaluating Order-to-Cash Cycle Performance

These metrics are crucial for maintaining a smooth and efficient order-to-cash cycle, contributing to improved financial performance and operational excellence within the company.

1) Revenue Contribution

This metric assesses the proportion of revenue generated through the order-to-cash process, indicating its impact on overall earnings and core business functions.

2) Productivity Per Full Time Equivalent (FTE)

Comparing total order-to-cash process output to that of each FTE helps gauge individual productivity levels, informing resource allocation and workload management decisions.

3) Days Sales Outstanding (DSO)

Calculate DSO to evaluate revenue collection efficiency, implement effective debt management strategies, and maintain healthy cash flow levels.

4) Regular Reporting

Generate detailed reports on discounts, order errors, aging accounts, and KPIs to maintain transparency, facilitate data-driven decision-making, and drive continuous process improvements.

5) Automation Utilization

Monitoring the extent of process automation and improvements helps reduce errors, speed up order fulfillment, enhance cash collection, and optimize overall operations efficiency.

Best Practices for Order to Cash

Here are some best practices to enhance your Order-to-cash (O2C) process and accelerate payment collection while improving your bottom line:

1) Conduct Process Analysis

Begin by thoroughly analyzing your current process to identify any inefficiencies or areas for improvement. Consider automation solutions to address manual tasks and streamline operations where necessary.

2) Prioritize Incremental Changes

Focus on making small, impactful changes initially. Target areas with the most significant potential for improvement to gain quick wins and build momentum for larger-scale enhancements.

3) Emphasize Integration

Select automation tools that integrate smoothly with your existing systems, such as ERP software, to ensure seamless operation and data consistency. This ensures data consistency and minimizes the risk of information loss, enhancing overall process efficiency.

4) Implement Automation

Utilize no-code automation solutions to automate critical aspects of your order to cash automation process swiftly. Automation boosts operational efficiency, improving customer satisfaction and better business outcomes.

Useful Link: 5 Key Benefits of Implementing Cloud Financial Services for Your Business

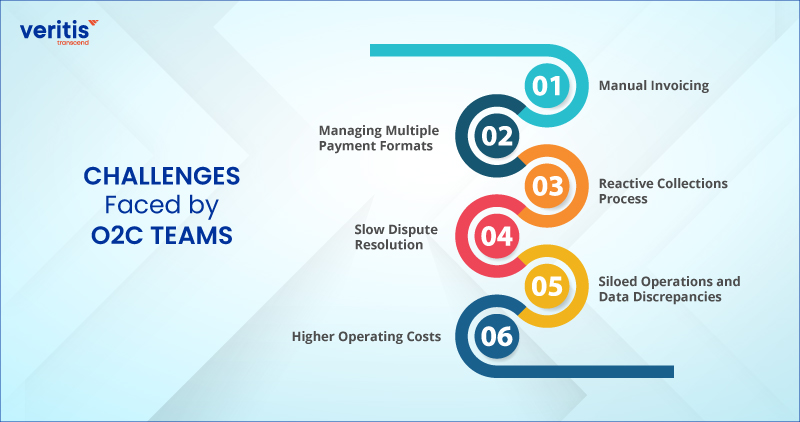

Challenges Faced by O2C Teams

One of the primary challenges accounts receivable teams encounter is operating in isolation, leading to a lack of coordination between credit and collection activities. This siloed approach results in subpar customer experiences, prolonged Days of Sales Outstanding (DSO), and increased write-offs.

Let’s explore some key issues faced by O2C teams

1) Manual Invoicing

Due to diverse customer preferences, many organizations still rely on manual processes for creating invoices. Large clients may prefer invoices uploaded to their Accounts Payable (A/P) portals, while small and medium-sized businesses (SMBs) prefer paper-based ones. This manual invoicing process is time-consuming and prone to errors.

2) Managing Multiple Payment Formats

As businesses operate globally, accounts receivable teams must handle various payment methods such as checks, ACH, credit cards, BACS, and SEPA. Dealing with international payments also involves navigating foreign exchange charges, adding complexity to the task.

3) Reactive Collections Process

Collections teams often lack real-time visibility into customer credit risks and payment statuses. This leads to inefficient prioritization of collections efforts, resulting in missed opportunities to engage with at-risk customers promptly.

4) Slow Dispute Resolution

Resolving customer disputes involves manually collecting claim documents, proof of deliveries, and bills of lading. This time-intensive manual investigation process can delay resolving disputes and recovering owed funds.

5) Siloed Operations and Data Discrepancies

The lack of integrated operations in the Order to Cash cycle leads to operational inefficiencies. For instance, collectors may reach out to customers without visibility into their payment status, resulting in poor customer experiences and delayed recovery efforts.

6) Higher Operating Costs

Large companies often incur higher operating costs associated with bank lockbox fees, billing expenses, and invoicing costs within the order-to-cash process. These increased expenses, coupled with slow receivables recovery, can impact working capital availability

Useful Link: The Role of Automation in FinOps: Streamlining Cloud Cost Management

Benefits of Order to Cash

Implementing and standardizing the diverse functions within the Order-to-Cash (O2C) process can significantly benefit your organization. Here are the key advantages of O2C automation:

1) Employee Satisfaction

Automation frees employees from mundane tasks, boosting morale and productivity and allowing them to focus on strategic activities.

2) Improved Customer Satisfaction

Digital O2C processes offer a seamless buying experience, enhancing customer satisfaction and loyalty while protecting your brand’s reputation.

3) Accuracy

Digital solutions automate manual tasks like order management, invoicing, and revenue recognition, ensuring accuracy and reducing human errors such as typos or improper data entry.

4) Enhanced Visibility

Automation provides real-time visibility into O2C processes, simplifying reporting, auditing, and data analytics for informed decision-making.

5) Profitability

O2C automation optimizes AR functions, improves cash flow, reduces time-to-market, enables digital business models, and enhances profitability.

6) Enhanced Speed and Efficiency

Automating the core steps of the O2C process, such as order and credit management, shipping, invoicing, accounts receivable (AR), payment collections, and data management, facilitates seamless coordination and collaboration across departments. Automation reduces friction, eliminates bottlenecks, minimizes delays, and reduces errors.

7) Scalability

Cloud-based automation solutions are designed to scale your business, effortlessly accommodating increased transaction volumes due to growth, mergers, or acquisitions.

Adopting a digital mindset and leveraging automation technologies are crucial for organizations navigating digital transformation and staying competitive in today’s business era. Automation enables agility, innovation, and efficiency, driving business excellence and long-term success.

How Veritis Can Offer Support?

Veritis, recognized as a winner of prestigious business awards such as Stevie and Globee, offers comprehensive solutions for automating the order-to-cash process. Our O2C services are designed to optimize early revenue recognition, reduce Days Sales Outstanding (DSO), and enhance overall user satisfaction. Our specialized services encompass revenue assurance solutions, pricing analytics, industry analytics, cash flow analytics, and fraud management, catering to diverse business needs.

Looking for Support? Schedule A Call

Also Read:

- 7 Essential AI Tools Every CTO Should Be Familiar With

- The Rise of Artificial Intelligence and Machine Learning in Financial Decision Making Processes

- Securing the Future: AI Automation Tools in Cybersecurity

- Impact of Information Technology on the Financial Industry

- The Future of IT Financial Management: Trends and Innovations

- How Financial Risk Management Software Mitigates Fraud in the Financial Industry